The Finance Bill 2023 introduced a significant change aimed at limiting LTCG (Long Term Capital Gain) advantages by reclassifying gains from ‘specified mutual funds’ as short-term capital gains (STCG).

But what exactly are these Specified Mutual Fund Schemes according to the Income Tax Act? And what’s the key modification regarding the taxation of gains from specified mutual funds for FY 2023-24 (AY 2024-25)?

Defining Specified Mutual Fund Schemes under the Income Tax Act

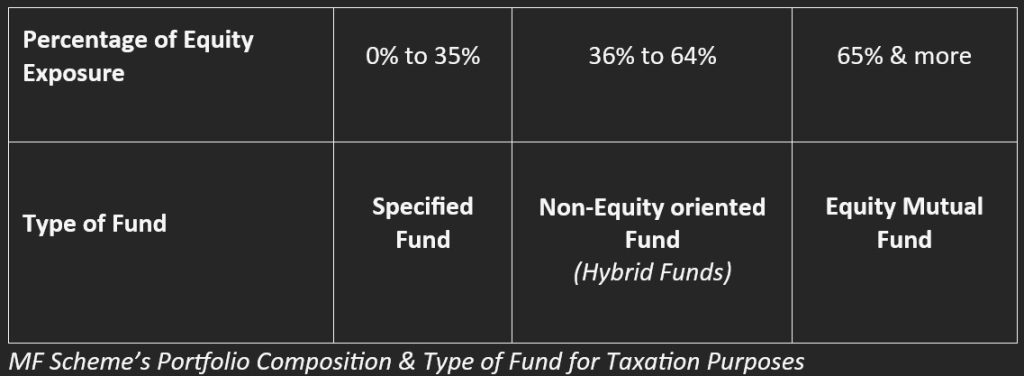

A specified mutual fund, regardless of its name, is one where no more than 35% of its total proceeds are invested in domestic companies’ equity shares. This category includes Liquid Funds, Short Duration Debt Funds, Gold Mutual Funds, and Fund of Funds, among others.

For the purposes of section 50AA of the Income Tax Act, “specified mutual fund” means a mutual fund by whatever name called, where not more than 35% of its total proceeds is invested in the equity shares of domestic companies. Accordingly, an “equity-oriented fund” that invests in units of another fund instead of investing directly in equity shares of domestic companies may be regarded as a “specified mutual fund”. – AMFI

This new amendment effectively creates three broad fund categories: Equity, Non-Equity, and Specified Funds.

The New Tax Amendment for Specified Mutual Funds

To grasp this change, let’s first review how mutual fund capital gains are classified as Short-term or Long-term.

Holding Period & Capital Gains Classification for Mutual Funds

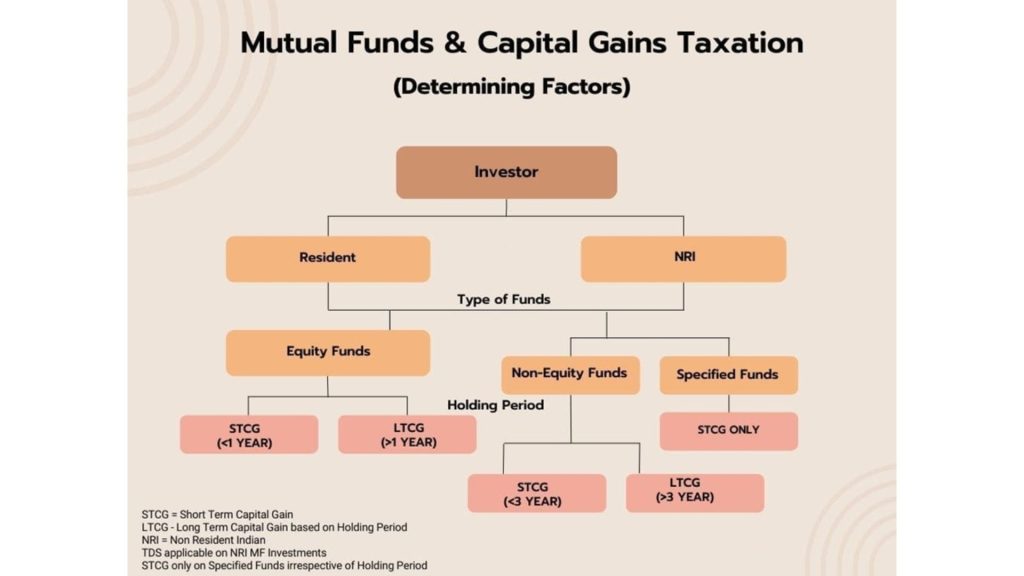

Mutual fund capital gains are categorized as either long-term or short-term, based on the investment duration.

- Long Term Capital Gains

- For Equity Mutual Funds, gains from units held over 1 year are classified as Long-Term Capital Gains.

- For Non-Equity Mutual Funds (including Debt Funds), gains from units held over 3 years are classified as Long Term Capital Gains.

- Short Term Capital Gains

- For Equity Mutual Funds, gains from units held less than 1 year are considered Short Term Capital Gains.

- For Non-Equity Mutual Funds, gains from units held less than 36 months (3 years) are treated as Short Term Capital Gains.

The amendment we’re discussing pertains to non-equity-oriented funds.

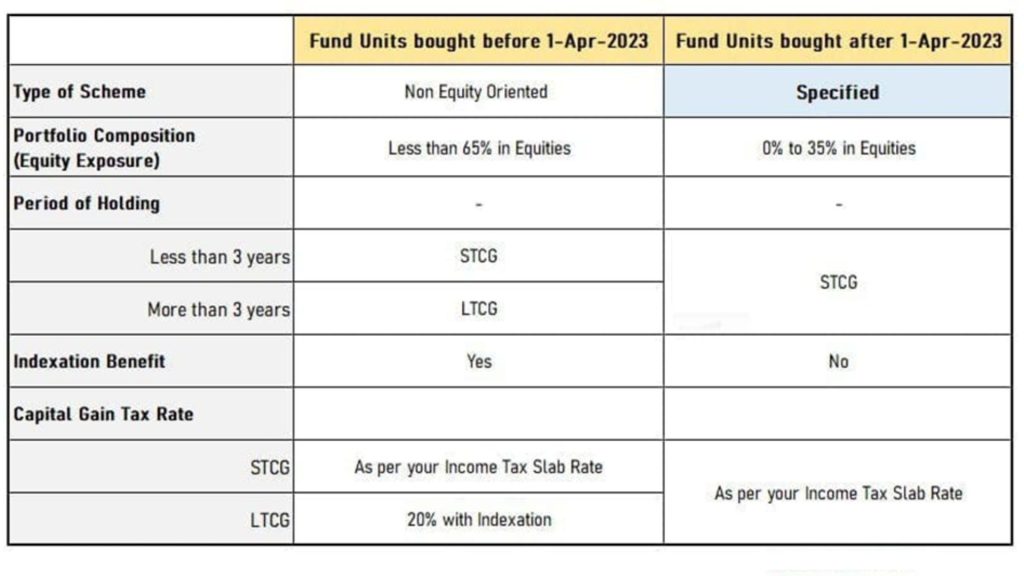

Under the new rule, capital gains from transferring or redeeming units of “specified mutual fund schemes” acquired on or after April 1, 2023, are treated as short-term capital gains. These gains are taxable at applicable income tax slab rates, regardless of how long the units were held.

Consequently, the indexation benefit is no longer available when calculating long-term capital gains on Specified Mutual Funds. This change means that the benefits of lower tax rates and indexation previously available for LTCG on non-equity mutual funds will be replaced by taxation at the maximum marginal rate, as applicable to STCG.

However, since these gains are still categorized as capital gains, investors can offset any other short-term capital losses against capital gains from specified mutual funds.

It’s important to note that if you purchased units of a non-equity-oriented fund before April 1, 2023, this new tax rule doesn’t apply.