Feeling overwhelmed by the world of investing? Don’t worry – you’re not the only one! This guide is here to slice through the confusion and reveal the stock market’s hidden treasures. Learn how to become a savvy investor, snagging slices of ownership in businesses you admire (or maybe just tolerate), and potentially watch your money grow. Buckle up for a journey into investing – it’s way less complicated than you might think! Let’s kick things off with some stock market fundamentals.

At first glance, the stock market can seem like a dizzying universe of charts, numbers, and lightning-fast transactions. But here’s the exciting part: strip away the fancy lingo, and you’ll find a captivating arena where regular folks can grab a piece of the corporate pie. Picture it as a massive digital bazaar where investors (yes, that could be you!) buy and sell tiny ownership chunks (we call them shares) in companies they believe have a bright future.

This crash course in stock market basics will arm you with essential knowledge, walking you through key ideas like what shares really are, why you need a Demat account, and how businesses use the stock market to fuel their growth. We’ll dive into the push-and-pull between optimistic investors (those betting a company’s value will climb) and the more cautious crowd (who think it might stumble). Once you grasp these core concepts, you’ll be well-equipped to dip your toes into the thrilling waters of stock market investing!

1. About Investment Needs

Unlocking Your Money’s Hidden Potential

Ever feel like you’re stuck in a financial hamster wheel? You’re making decent money, squirreling away savings each month, but after two decades, you’re barely scraping by for a comfortable retirement. What gives?

Enter the sneaky villain: inflation. This silent thief nibbles away at your hard-earned cash, leaving you with less purchasing power over time. So, how do we fight back?

Investing: Your Ticket to Financial Independence

Here’s where investing swoops in to save the day! It’s your chance to outpace inflation and watch your wealth grow. Picture this: instead of letting your savings gather dust, you put them to work in assets like stocks or mutual funds that have the potential to increase in value.

The Magic of Compound Interest: Your Financial Superpower

Imagine a tiny snowball rolling down a hill. It starts off puny, but as it tumbles, it picks up speed and size, becoming a force to be reckoned with. That’s exactly how compound interest works in investing. Your initial returns get reinvested, earning even more returns on top. The longer you stay in the game, the more jaw-dropping this effect becomes.

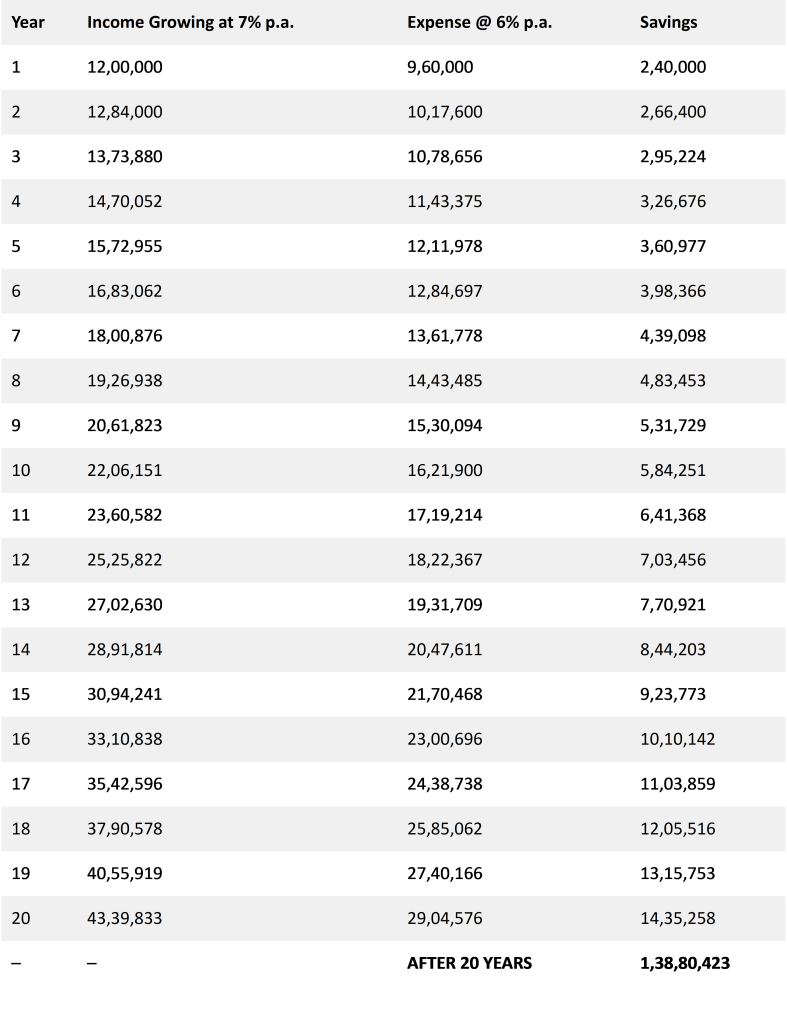

Scenario: The Savings-Only Trap

Let’s crunch some numbers. Say you’re 40 years old and manage to tuck away Rs.20,000 every month. That’s a respectable Rs.2,40,000 per year. Now, assuming your income grows by about 7.5% annually and your expenses creep up by 6% each year, how much will you have saved up in 20 years? Drumroll, please… It comes to around Rs.1.38 Crores.

Sounds impressive, right? But hold that thought – we’re about to see how investing can take your financial future to a whole new level!

Hold up! Let’s take a closer look at those numbers. By year 20, your annual expenses have ballooned to a whopping Rs.29 Lakhs. At this rate, you’ll burn through all your savings in just 5 years. And remember, you’re likely retired by now. So what happens when that money runs out? How will you keep the lights on with an empty bank account?

But wait, there’s more…

I’ve been generous with that 6% annual expense growth. It matches the projected average inflation rate for India over the next two decades. But here’s the kicker – if your expenses only grow at the inflation rate, your lifestyle stays frozen in time. No upgrades, no improvements. To actually boost your quality of life, your expenses need to outpace inflation.

And if those expenses climb faster? Your savings at the 20-year mark shrink even further. Yikes!

So, what’s the fix? Let’s explore another scenario.

Scenario 2: Investing – Your Financial Turbocharger

Now, picture this: You take that same Rs.20,000 and invest it, earning a 12% annual return. Fast forward 20 years, and you’re sitting pretty on Rs.3.56 Crore! That’s a mind-blowing 2.5 times more than just saving alone.

Time for the million-rupee question: Why invest?

Why Investing is Your Financial Superhero

Here’s the deal:

1. Inflation-Busting Power: While inflation sneaks around, eroding your purchasing power, investing stands guard. It helps your money keep up with (and potentially outpace) rising costs, protecting your future buying power.

2. Wealth Amplifier: Investing turns your savings into a growth machine. It can transform your nest egg into a fortune, ready to fuel your wildest dreams – whether that’s a cushy retirement, top-notch education for the kids, or that bucket-list adventure you’ve been dreaming about.

3. Your Financial Safety Net: Think of investing as building a cushion for life’s curveballs. A robust investment portfolio can catch you when unexpected expenses pop up, giving you that priceless peace of mind.

Investing isn’t just smart – it’s your ticket to financial freedom. Don’t wait! Start growing your money today and watch your financial future transform before your eyes!

2. Where to Park Your Cash: The Investment Smorgasbord

Now that you’re sold on the power of investing, let’s dive into the exciting world of asset classes. Think of these as the main ingredients in your financial recipe – each one brings something different to the table.

Your Investment Menu: A Feast of Options

1. Fixed Income Fare: These are your comfort food investments. They serve up predictable returns, like interest payments on a loan. We’re talking government bonds, bank deposits, and corporate IOUs. While you’re unlikely to lose your initial investment, the returns might struggle to keep pace with inflation (hovering around 6% per year).

2. Equity Entrees: Here’s where you get a slice of the corporate pie by snagging shares in companies. These tasty morsels are traded on stock exchanges. While equity investments have historically dished out some mouth-watering returns, they can be a wild ride – their value can swing up and down like a rollercoaster. For the seasoned investor, equities can potentially serve up returns around 12% per year.

3. Real Estate Roasts: This involves sinking your teeth into land or buildings. You can enjoy a steady diet of rental income and potentially feast on rising property values. But be warned – real estate deals can be tough to chew, and you’ll need a hefty appetite (and wallet) to get started. If you’re after rental income, a property might yield about 7% per year over two decades. You might also see the value of your property itself grow by roughly 5% annually.

4. Commodity Courses: Gold and silver are the classic choices here. Their value tends to simmer nicely over time, offering a tasty hedge against inflation. You can invest in the physical metals or through exchange-traded funds (ETFs) on the stock market. On average, precious metals might serve up returns of about 8% per year over a 20-year stretch.

So, what’s the next bite?

Seeing those juicy equity returns, you might be tempted to load up your entire plate. But hold your horses!

A savvy investor spreads their wealth across different asset classes. We call this asset allocation (or investment diversification).

How you divide up your investment pie can shift as you age. A young investor with time on their side might pile more on the equity portion of their plate. Meanwhile, a retiree looking for stability might prefer a heavier helping of fixed-income investments.

Remember, the key to a satisfying financial feast is finding the right balance for your taste and risk appetite!

Note

Before you dive headfirst into the investment pool, let's get you suited up with some essential knowledge. First things first: risk and return are like two sides of the same coin. Generally speaking, the juicier the potential returns, the spicier the risk of losing your hard-earned cash.

Let’s start with fixed-income investments. They’re like the vanilla ice cream of the financial world – safe, reliable, but not exactly thrilling. While they’ll keep your initial investment intact, don’t expect them to outrun inflation in the long haul.

Now, equities – these are the rollercoaster rides of investing. They can send your returns soaring high, but buckle up for some stomach-dropping plunges too. Sure, they might leave inflation in the dust over time, but be ready for a bumpy journey.

Real estate? It’s not for the faint of heart. You’ll need deep pockets to get started, and selling quickly can be trickier than getting gum out of your hair. It’s a complex beast, this one.

Then there’s gold and silver – the comfort blankets of the investment world. People flock to them when times get tough, but don’t expect mind-blowing returns based on their track record.

So, when you’re plotting your investment strategy, weigh these factors like you’re balancing a seesaw. Make choices that align with your goals and how much excitement (or risk) you can handle.

Remember, building wealth is more marathon than sprint. By getting cozy with different asset types and taking smart risks, you can unleash your money’s true potential. Watch out, world – your wealth is about to take off!

3. The Stock Market: A Layman’s Guide

Picture the stock market as a buzzing marketplace, but instead of fruits and veggies, folks are wheeling and dealing pieces of companies. Imagine a massive hall filled with booths, each one representing a different business. These booths are where company shares change hands. Let’s break it down even further.

Say you’ve got your eye on investing in a company – we’ll call it ABC Corp. You’d mosey on over to the “ABC Corp” booth and snag some of their shares. Boom! You’re now a part-owner of that business.

If ABC Corp starts crushing it and raking in the dough, your shares become more valuable. On the flip side, if they hit a rough patch, your shares might take a nosedive.

This constant ebb and flow of share prices is what makes the stock market tick. It’s influenced by all sorts of things – how well companies are performing, what’s happening in the economy, and whether investors are feeling bullish or bearish.

So, in a nutshell, the stock market is like a colossal bazaar. But here’s the kicker – there’s always a chance you could lose your shirt. That’s why it’s crucial to do your homework and understand the game before diving in headfirst.

Why Do We Need This Stock Market Contraption Anyway?

The stock market is like a turbocharger for companies looking to grow. Let’s break it down with a simple example. Imagine a corner store dreaming of expanding into a chain. To drum up the cash for new locations, inventory, and staff, they’ve got two main options: take out a whopping loan or sell shares on the stock market.

Now, think of buying shares as becoming a mini-boss of the company. When you snap up shares in that clothing brand, you’re essentially buying a tiny piece of their empire. You won’t be calling the shots on what t-shirts to stock, but you’ll have skin in the game of the brand’s success.

Here’s where it gets juicy: as the company starts killing it and raking in the profits, the value of your shares goes up. You might even get a slice of the company’s profits, known as a dividend.

The stock market is a complex beast, but hopefully, this explanation gives you a taste of how the whole shebang works!

Who’s Playing in This Stock Market Game?

The stock market isn’t just a one-man show – it’s a bustling circus of players, each with their own part to play. Unlike your neighborhood shop with a friendly face behind the counter, this market runs on electronic wizardry, connecting you with a whole zoo of buyers and sellers.

The Day Traders: Right in the thick of it, you’ve got regular folks like you and me (we call ’em retail investors). We jump in by opening a brokerage account and use it to swap company shares like baseball cards. We’re influenced by all sorts of stuff – juicy company gossip, market vibes, and our own money dreams.

The Globe-Trotters: This market party isn’t just for locals. Foreign investors (FIIs) crash the scene from all corners of the world. They might have a crush on India’s growth potential or just want to spread their bets around. These international players can really juice up the market’s energy and stability.

The Homegrown Heavyweights: Big Indian institutions like LIC are the elephants in the room. They’re sitting on mountains of cash and buy stocks to keep their policyholders’ piggy banks nice and plump. When these big boys make a move, the whole market feels it.

The Mix Masters: Mutual fund companies are like financial DJs. They take cash from a bunch of different people and blend it into a cocktail of stocks. This lets average Joes get a taste of a diverse portfolio without having to pick stocks themselves. These funds help keep the market steady and accessible to the masses.

Together, this colorful crew of market players creates a non-stop dance of supply and demand that makes stock prices boogie up and down. It’s like a giant, never-ending financial block party!

The SEBI Show: Keeping the Market Honest

With all that cash flowing and the promise of big bucks, the stock market can sometimes feel like the Wild West. That’s where SEBI (Securities and Exchange Board of India) steps in – think of them as the sheriff in town, keeping everyone in line.

SEBI’s got a lot on its plate, looking out for everyone in this financial rodeo:

Keeping the Game Fair: SEBI makes sure the big stock exchanges like BSE and NSE play by the rules. They’re on the lookout for sneaky stuff like insider trading (using secret info to make a quick buck) and market manipulation (messing with stock prices artificially). It’s all about keeping the playing field level.

Watching Your Back: SEBI’s your bodyguard against scams and shady business. They make sure companies spill the beans on their financial health. Thanks to SEBI, listed companies have to share their money info with everyone. This way, you’re not investing blind – you’ve got the facts to make smart choices.

Helping the Market Grow: SEBI’s not just about cracking the whip. They’re also the coach, setting up rules that help the market stay healthy and grow. They keep stockbrokers in check, making sure they treat you right. All this builds trust and gets more folks to join the investing game.

SEBI’s Got Eyes Everywhere

To keep things running smoothly, SEBI’s got its fingers in a lot of pies:

Stock Exchanges: The big boys like BSE and NSE have to dance to SEBI’s tune. SEBI makes sure they’re running a tight ship, with fair rules for everyone.

Stockbrokers: These are the folks who help you buy and sell stocks. SEBI keeps them on a short leash – they’ve got to register and follow strict rules about treating customers right. Think Zerodha, Groww, Upstox, and the broker arms of big banks.

Listed Companies: Want to raise money on the stock market? You’ve got to play by SEBI’s rules. That means sharing your financial report card regularly and being upfront about anything big happening in the company. It’s all about keeping you in the loop. We’re talking big names like Reliance, TCS, L&T, HDFC Bank, Tata Steel – they all have to toe the line.

By keeping everyone honest, SEBI makes sure the stock market’s a fair game. It’s not just about protecting your wallet – it’s about helping the whole financial system grow up strong and healthy.

4. The Big Players in the Stock Market Game

Imagine grabbing a tiny piece of your favorite company. That’s basically what happens in the stock market! But to join this party, you’ll need some trusty sidekicks.

Let’s meet the crew who’ll help you navigate this wild world of investing.

4.1 Stockbrokers: Your Market Wingmen

To dive into this marketplace and start wheeling and dealing shares, you need a reliable buddy – enter the stockbroker. These folks are your bridge to the stock world, helping you buy and sell like a pro.

Picking the right broker is like choosing a dance partner – it can make or break your trading experience. Here’s the lowdown on what to look for:

Old School vs. New School Brokers:

Full-Service Brokers: These are the traditional types. They’ll hold your hand, give you personalized advice, and even manage your portfolio. But all that TLC comes with a hefty price tag.

Discount Brokers: These tech-savvy upstarts are for the DIY crowd. They offer slick online platforms with cool tools at bargain-basement prices. Just don’t expect them to tell you what to buy or sell.

Trading Platform Bells and Whistles:

Fancy Charts: Analyze stock moves and spot opportunities with techy indicators and charts.

Real-time Market Buzz: Stay in the loop with up-to-the-second stock prices, news, and market gossip.

Flexible Order Placing: Place different types of orders to fine-tune your strategy and manage risk.

Research and Learning Goodies:

Expert Market Reports: Get the inside scoop from financial eggheads to make smarter choices.

Webinars and How-To’s: Some brokers offer free classes to boost your market smarts.

Customer Service:

Reachability: Make sure your broker’s got your back with multiple ways to get help (phone, email, chat) and a rep for quick, helpful responses.

Extra Stuff to Chew On:

While these are the basics, think about what YOU need:

Minimum Buy-In: Some brokers want a big chunk of change to get started. Not great if you’re just dipping your toes in.

Fees and Commissions: Compare the costs – account opening fees, yearly charges, and what they take per trade.

Margin Trading: If you’re feeling risky and want to trade on borrowed money, make sure your broker offers it (but know the dangers!).

Remember, choosing a broker is like picking a teammate. Find one that fits your style, your wallet, and your goals. Happy broker hunting!

4.2 Demat Accounts: Your Digital Piggy Bank for Stocks

Back in the day, owning shares was like collecting fancy IOUs. You’d get these swanky paper certificates as proof you owned a piece of the company pie. But just like everything else, the money world’s gone digital.

Enter the Demat account – think of it as your high-tech vault for keeping all your investment goodies safe and sound in electronic form.

A Demat account (that’s short for dematerialized, fancy, right?) is like a digital safety deposit box for your shares. Instead of stuffing paper under your mattress, your stocks live in this virtual space. It’s not just simpler – it’s way safer and more convenient.

Why Demat Accounts Rock:

These digital vaults have some serious perks over the old-school paper way:

Fort Knox-Level Security: Say goodbye to worrying about your dog eating your share certificates or a burglar swiping them. Your digital shares are locked up tight.

Lazy Investor’s Dream: Buying, selling, or moving shares around is as easy as ordering pizza online. No more paperwork headaches!

Speed Demon: When you trade, ownership changes hands faster than you can say “bull market.” It’s all electronic, baby.

Penny Pincher’s Paradise: No more printing costs or renting a storage unit for your paper mountain. It’s all in the cloud, saving you some serious cash.

Slice and Dice Investing: Want to own just a tiny slice of a pricey stock? Demat accounts let you buy fractional shares, making it easier to build a diverse portfolio without breaking the bank.

So, think of your Demat account as your personal, digital Fort Knox for stocks. It’s safer, faster, and way cooler than a pile of fancy paper. Welcome to investing in the 21st century!

4.3 The Depositories: Your Stock’s Digital Vault

Just like banks keep your cash safe, depositories are the Fort Knox for your digital stocks. In India, we’ve got two big players in this game:

NSDL (National Securities Depository Limited): The OG of electronic shareholding in India, born in 1996. They’ve got a rock-solid setup and a ton of buddies (called Depository Participants or DPs) to help you access your account.

CDSL (Central Depository Services Limited): The new kid on the block, launched in 1999. They’re all about that tech life and coming up with cool new ideas. They’ve also got a bunch of DP friends to help you out.

The DPs: Your Depository Wingmen

The big depositories don’t deal with us regular folks directly. Instead, they’ve got these middlemen called Depository Participants (DPs). These can be banks, online brokers, or other money folks that SEBI (the stock market police) says are cool to handle Demat accounts.

You’ll open your Demat account with a DP, and they’ll be your go-to for managing your digital stock stash. They’ll help you buy, sell, and move shares around like a pro.

4.4 Banks: The Money Pipeline

The stock market’s a complicated machine, and behind the scenes, there’s a whole lot of info and cash flying around to keep things running smooth. In this wild world, three key accounts work together like a well-oiled machine – your trading account, Demat account, and good old bank account.

Trading account: This is where the action happens. You place your buy and sell orders here, keep track of what you own, and can watch the market do its thing. But to make moves, you need cash and shares in this account.

Demat account: Think of this as your high-tech safe deposit box for shares. It’s where your stocks live in digital form, no paper certificates needed.

Bank account: This is your financial gas tank for your investing road trip. It’s where you keep the cash you’ll use to buy shares through your trading account. When you sell shares, the money comes back here.

After you buy or sell shares, there’s a little waiting period (usually 2 days in India). On settlement day, the cash moves from your trading account to the seller’s, and the shares zip from the seller’s Demat account to yours. It’s like a perfectly choreographed dance of money and stocks.

4.5 Clearing Corporations: The Stock Market’s Referees

When you’re buying or selling shares, you want to be 100% sure you’ll get what you paid for, and the seller will get their cash. That’s where two super important groups come in – NSCCL and ICCL. Let’s break it down:

NSCCL (NSE’s Buddy)

Let’s say you’re Team Tata and want to buy some Tata Motors shares on the NSE. You tell your broker to grab 100 shares for you.

Behind the scenes, NSCCL plays middleman between you and the seller. They don’t actually touch the money or shares, but they promise everything will go smoothly.

Once your trade is locked in, NSCCL becomes the guardian angel of the deal. They make sure those 100 shares end up in your Demat account and your cash finds its way to the seller.

This way, nobody can back out of the deal. NSCCL is like a superhero, keeping both buyer and seller safe and happy.

ICCL does the same thing, but for trades on the BSE.

5. A Startup’s Journey

Picture a hot new FinTech company with stars in its eyes. In this part, we’re going to follow their money-raising adventure and explain why companies like this eventually decide to go public (that’s fancy talk for having an IPO).

Humble Beginnings: From Dream to Dollar

Picture this: Our plucky entrepreneur’s got a killer idea that’s gonna shake up the FinTech world. They’ve got the vision, they’ve got the fire in their belly, but there’s one tiny problem – their wallet’s looking pretty empty. This is where seed money and angel investors swoop in to save the day.

Seed Money: Think of this as the magic beans that help a startup sprout. It’s the initial cash injection that gets things rolling. This moolah might come from the entrepreneur’s piggy bank, a small business loan, or more likely, from angel investors. It’s used for the crucial stuff like figuring out if people actually want their product, building a prototype, and generally getting the ball rolling.

Angel Investors: These folks are like fairy godparents with deep pockets. They’re often loaded individuals who get a kick out of backing early-stage ventures. Unlike stuffy bankers who just want their money back with interest, angel investors might be in it because they love the idea, think the entrepreneur’s got the secret sauce, or just want to help the next big thing grow.

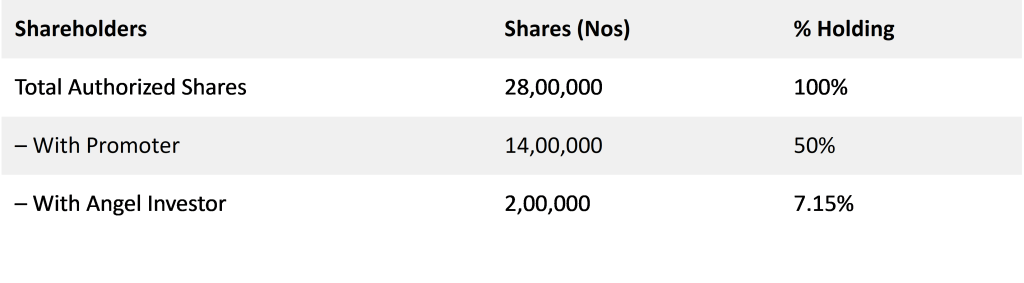

Now, these angels don’t just hand over cash for free. In exchange for their seed money, they get a slice of the startup pie. Yep, they become part-owners of the company by getting shares. How big a slice they get depends on how much cash they fork over and how smooth a talker the entrepreneur is during negotiations.

Check out this example of how the ownership might look after the angel investor hops on board:

Let’s be real – this seed funding stage is like walking a tightrope. A lot of startups crash and burn. But for the ones that make it? The payoff can be astronomical. Angel investors know this game – it’s high risk, but potentially high reward.

They’re not just throwing money at a business plan. They’re placing a bet on a passionate entrepreneur with stars in their eyes and an idea that could change the world. It’s part investment, part adventure, and a whole lot of faith in human potential.

Building the Business: Time to Supercharge

Alright, our startup’s catching fire! Customers are loving it, and our entrepreneur’s ready to pour gasoline on this flame. But here’s the thing – to really crank things up, they need some serious cash.

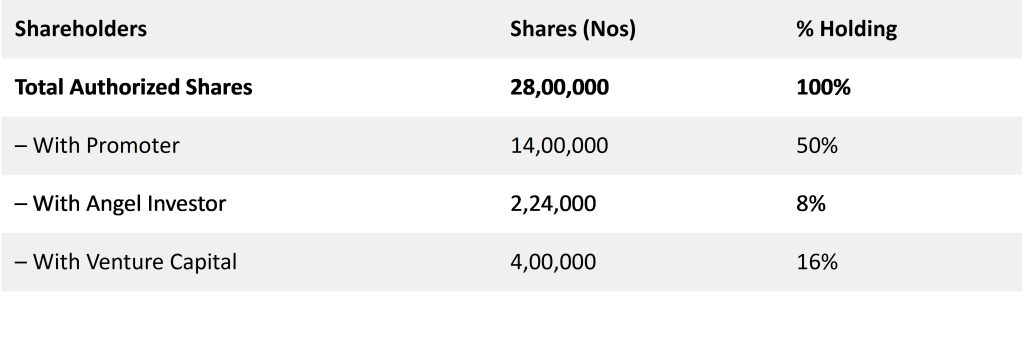

Enter the venture capitalist (VC), the big kahuna of the investing world. These folks are about to dump a truckload of money into our startup to help it shoot for the stars.

Venture Capitalists: These aren’t your friendly neighborhood angel investors. VCs are the pros – investment firms that specialize in throwing big bucks at startups they think could be the next big thing. They don’t just go with their gut like angels might. Nope, VCs put startups through the wringer, checking out stuff like how big the market could be, whether the management team’s got the chops, and if the business can grow like crazy.

The cash VCs bring to the table? We’re talking millions, baby. This isn’t pocket change – it’s rocket fuel. With this kind of dough, our startup can go wild with marketing blitzes, hire a small army of tech wizards, and maybe even start opening offices in exotic locales.

Check out how the ownership pie might look after the VC drops their cash bomb:

Now, here’s where things get spicy. As the startup grows thanks to all this VC cash, its perceived value in the market (that’s what the fancy folks call “valuation”) goes through the roof. This valuation is like a crystal ball, showing what people think the company could be worth down the line based on how much money it might make and how much of the market it could gobble up.

And here’s the kicker – the higher that valuation climbs, the more the VC firm’s eyes turn into dollar signs. Why? Because when the company eventually goes public (has an IPO) or gets bought out, the VC stands to make a killing.

It’s like they’re planting magic beans, watering them with millions of dollars, and hoping a giant beanstalk of profit sprouts up. High risk? You bet. But if it pays off, we’re talking “buy your own island” kind of money.

6. The IPO Adventure: When Startups Hit the Big Leagues

Picture this: A company’s been grinding for years, perfecting their secret sauce and building a loyal fanbase. Now they’re ready to blast off into the stratosphere, but they need some serious rocket fuel. Enter the wild world of Initial Public Offerings (IPOs). But what’s this IPO business all about, and how does a company navigate this crazy ride? Buckle up, folks – we’re about to spill the tea on going public!

Stepping into the Spotlight

An IPO is like a company’s debutante ball. They’re selling pieces of themselves to the public for the first time, raking in a mountain of cash in the process. This money tsunami can be used for all sorts of cool stuff – maybe they want to take over the world (or at least expand operations), cook up some fancy new products, or go on a shopping spree for other businesses. But why would a company want to go public in the first place?

Ca-ching!: IPOs are like opening a fire hydrant of money. Suddenly, every Tom, Dick, and Harry can invest in your company.

Show Me the Money: Those early investors like VCs can finally cash out by selling their shares on the stock market. It’s payday, baby!

Fame and Fortune: Going public is like getting a star on the Hollywood Walk of Fame. Suddenly, everyone knows your name.

Talent Magnet: Public companies can lure in the cream of the crop by dangling shiny stock options in front of them.

The Merchant Banker: Your IPO Wingman

Pulling off a killer IPO is like orchestrating a symphony – you need a maestro to keep everything in tune. Enter the merchant banker. This financial wizard is your guide through the IPO jungle, making sure you don’t get eaten by regulatory tigers or fall into paperwork quicksand. Here’s what they do:

Sherlock Holmes Mode: They dig deep into your company’s financial underwear drawer, making sure everything’s squeaky clean.

Paperwork Ninja: They whip up the prospectus – a fancy document that spills all the juicy details about your company’s finances, plans, and potential pitfalls.

Price is Right: They figure out how much your shares should cost and throw some killer parties (aka roadshows) to get investors hyped about buying in.

So there you have it – the IPO journey in a nutshell. It’s a wild ride from startup dreamer to Wall Street darling. Who’s ready to ring that opening bell?

Steps Before IPO Goes Live: The Backstage Pass

Alright, folks! You think the IPO process is some mystical, complex ritual? Nah, it’s more like a carefully choreographed dance with specific moves. Let’s break down this pre-IPO tango, shall we?

Act 1: Picking Your Wingman – The Merchant Banker

First up, you need a financial wizard in your corner. This merchant banker’s gonna:

Play Sherlock Holmes, digging into your company’s financial dirty laundry (that’s the Due Diligence bit).

Whip up the prospectus – think of it as your company’s Tinder profile for investors.

Figure out how much your shares should cost and plan some killer parties (roadshows) to get investors hyped.

Act 2: Getting the Green Light – The SEBI Nod

Time to impress the big boss! You and your banker buddy cook up a detailed registration statement – it’s like your company’s life story, but with more numbers. You ship this off to SEBI (the stock market police) and cross your fingers they like what they see.

Act 3: The DRHP – Your IPO Playbook

SEBI gives you the thumbs up? Sweet! Now you craft the Draft Red Herring Prospectus (DRHP). This bad boy is like a treasure map for investors, showing off your financial muscles, introducing your dream team, and spilling the beans on how you’ll spend all that IPO cash.

Act 4: Hype Machine and Price Tags

DRHP’s out in the wild? Time to crank up the volume! Launch a media blitz and throw some swanky investor parties. Meanwhile, you and your banker pal decide on a price range for your shares – it’s like setting up guardrails for the bidding war to come.

Act 5: Book Building – Let the Games Begin!

This is where it gets spicy! Think of it like a reverse auction. Investors (both big shots and regular Joes) start throwing out bids for your shares within that price range you set. It’s all about figuring out how thirsty people are for a piece of your company pie.

Act 6: Listing Day – Showtime, Baby!

The big day arrives! Your company’s shares hit the stock exchange, and it’s off to the races. All those folks who snagged shares during the book-building frenzy can now start wheeling and dealing on the open market.

And there you have it – the IPO journey from backstage prep to center stage spotlight! Who’s ready to ring that opening bell?

IPO Lingo for Dummies

Alright, let’s decode some of this IPO mumbo-jumbo:

Subscription Levels: Think of it like a hot new restaurant. “Undersubscribed” means there are empty tables (fewer bids than shares). “Oversubscribed” is like a line out the door (more bids than shares).

Green Shoe Option: It’s the company’s secret stash of extra shares. If the IPO’s hotter than a jalapeno, they can whip these out to satisfy the hungry investors.

Fixed Price vs. Price Band: Some IPOs are like a set menu (fixed price). Others are more like “pay what you think it’s worth” within limits (price band).

Cut-Off Price: The final price tag slapped on the shares when they hit the stock market. It’s like when the auctioneer yells “Sold!”

7. The Stock Market: A Tasty Analogy

Picture this: You’re at the world’s coolest food festival with your buddy. You’re craving something spicier than a dragon’s breath, while your friend’s got a sweet tooth that could rot steel.

Now, let’s flip this to the stock market world. Imagine there’s a brand-new movie theater in town, and everyone’s buzzing about it. Some folks think it’ll be the next blockbuster hit and are scrambling for tickets. Others reckon it’s all hype and are trying to offload their tickets before the movie bombs.

In this wacky scenario:

You’re the optimist who thinks this movie’s gonna be the next “Avengers” (that’s one investor’s view).

Your buddy’s the skeptic who thinks it’ll flop harder than a fish out of water (another investor’s take).

Just like in the stock market, you and your pal have wildly different opinions about how this movie’s gonna pan out. And those opinions? They’re driving your actions – either snagging tickets or ditching them.

So there you are, elbowing your way to the ticket booth to grab your seats, while your friend’s frantically trying to sell their tickets on some sketchy online forum. The theater’s ticketing system is processing all these transactions, just like the stock exchange handles trades.

At its core, the stock market’s job is simple: it’s the ultimate matchmaker, hooking up buyers with sellers. Whether it’s slices of company pie or tickets to the next big flick, as long as people have different opinions (and they always will), there’ll be a market where they can wheel and deal.

So next time someone asks you about the stock market, just tell ’em it’s like a never-ending argument about whether a movie’s gonna be awesome or awful, but with money on the line!

What Makes Stocks Do the Cha-Cha?

Alright, buckle up! We’re about to dive into the wild world of stock movements. But forget boring examples – let’s spice things up with a cool company called BrightTech. These folks are all about that clean energy life.

Picture this: It’s a sunny morning on July 1st, 2024. BrightTech’s stock is chilling at Rs.50. Suddenly, BAM! News drops that BrightTech just scored a massive government deal to slap solar panels on everything. We’re talking a project so big, it makes your neighbor’s rooftop setup look like a kid’s science fair project.

Now, all the market players (that’s fancy talk for investors like you and me) are buzzing like they’ve chugged ten espressos. Why? Because this deal smells like money – loads of cash flowing into BrightTech’s pockets.

Let’s play a quick game of “What Would You Do?”:

a. How’s this juicy news gonna shake up BrightTech’s stock price?

b. If you were feeling frisky and wanted to make a move based on this hot gossip, what would you do?

The answer to the first question? It’s as obvious as a neon sign in a dark alley: that stock price is gonna shoot up faster than a rocket on Red Bull. This government contract news is like catnip for investors. It’s gonna make everyone and their grandma want a piece of BrightTech pie.

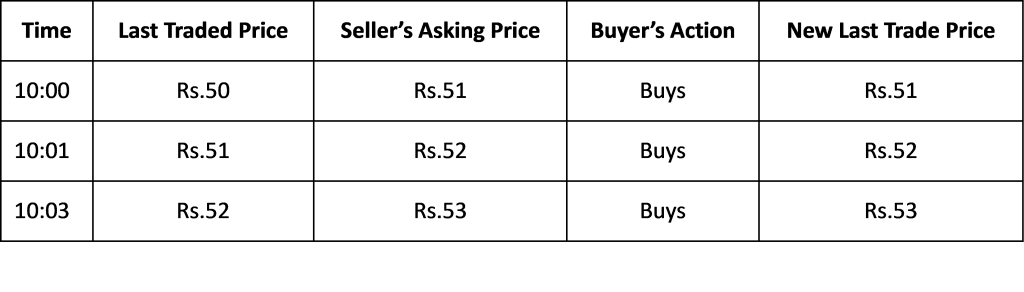

Now, let’s paint a picture of what’s going down:

See that? It’s like watching a stock market rollercoaster, but one that only goes up!

So, next time someone asks you why stocks move, just tell ’em it’s like high school gossip. One juicy rumor, and suddenly everyone either wants to be your best friend or sell you out. Only in this case, the gossip is corporate news, and instead of popularity, we’re talking cold, hard cash!

Alright, so our BrightTech stock is soaring like an eagle on Red Bull. Buyers are throwing money at it like it’s going out of style, all because of this juicy government contract news.

But hold onto your hats, folks! It’s high noon, and the plot just thickened. Some tree-hugging organization drops a bombshell report. They’re saying the government’s about to put renewable energy on a diet, cutting subsidies by a whopping 20%! Suddenly, our shiny BrightTech doesn’t look so bright anymore. Investors are sweating like they’re in a sauna made of money.

Let’s play another round of “What Would You Do?”:

a. How’s this new buzz gonna mess with BrightTech’s mojo?

b. If you were a big-shot trader, what move would you make now?

c. Are other green energy stocks gonna feel the heat too?

The answers? They’re about as clear as mud in a rainstorm (which means pretty darn clear):

BrightTech’s stock is about to take a nosedive faster than a skydiver without a parachute. All those eager buyers? They’re suddenly looking at BrightTech like it’s last week’s leftovers.

If you were a savvy trader, you’d be selling BrightTech shares faster than hot cakes at a lumberjack convention. It’s time to bail before this ship starts sinking!

And you bet your bottom dollar other renewable energy stocks are gonna catch this cold too. Investors are gonna get more skittish than a cat in a room full of rocking chairs when it comes to the whole green energy scene.

Here’s the deal: The stock market is like a giant mood ring. News and events are the fingers wearing it. Good news? The ring turns a happy green, and stocks go up. Bad news? It turns an angry red, and stocks take a tumble.

But here’s the kicker – even when there’s no news, stocks can still dance to the tune of supply and demand. It’s like a never-ending game of financial musical chairs!

So next time you’re watching the stock market, just remember: it’s basically a soap opera where the drama is measured in dollar signs. Lights, camera, transaction!

Stock Trading 101: The SolarTech Adventure

Alright, let’s dive into the wild world of stock trading with a cool company called SolarTech. These folks are the rock stars of solar panel manufacturing.

So, you’ve decided to go green with your cash and snag 100 shares of SolarTech at 50 bucks a pop. You’re in it for the long haul, baby!

But how does this financial magic trick work? Let’s break it down:

First, you log into your trading account. It’s like your secret lair for playing the stock market game.

You tell your account, “Hey, I want 100 SolarTech shares at 50 rupees each!”

This creates a ticket (think of it as your VIP pass to owning SolarTech). It’s got all the juicy details:

a. Who you are (the soon-to-be SolarTech mogul)

b. How much you’re willing to shell out per share

c. How many shares you want to get your hands on

Now, before your broker sends this order to the stock exchange, they do a quick wallet check. They’re making sure you’re not trying to buy a Ferrari with monopoly money.

If you’ve got the cash, your order zooms off to the stock exchange faster than you can say “solar-powered rocket”.

At the exchange, their fancy-schmancy computer starts playing matchmaker. It’s scanning the market like a desperate single at a speed dating event, looking for sellers who want to offload their SolarTech shares at your price.

Here’s the cool part: you don’t care if it’s one person selling all 100 shares or if it’s a bunch of people each selling a few. As long as you get your 100 shares at 50 bucks each, you’re golden.

Once the computer plays successful cupid, BAM! The shares magically appear in your DEMAT account (think of it as your digital stock vault). At the same time, they vanish from the seller’s account like a magician’s rabbit.

Now you’re a partial owner of SolarTech! If you’ve got 200 shares, you own a teeny-tiny slice of the company (like 0.000025%). It’s not much, but hey, you’re technically one of the bosses now! This means you might get dividends (free money, woohoo!), voting rights (time to flex those corporate muscles), and you get to join in on fun corporate shenanigans like stock splits or bonus issues.

So there you have it – you’re now officially a stock market player. Just remember, the stock market is like a roller coaster. Sometimes you’re up, sometimes you’re down, but it’s always a wild ride!

Types of Stock Market Players: Pick Your Poison!

Welcome to the wild jungle of the stock market, folks! Here, you’ve got two main tribes: the adrenaline-junkie traders and the zen-master investors. Let’s break ’em down!

Traders: The Fast and the Furious

These guys are like the day traders of Wall Street – quick on the draw and always chasing the next hot tip. We’ve got a few flavors:

1. Day Trader: These folks are in and out faster than a cat in a dog park. They buy and sell quicker than you can say “stock market crash”, all to avoid any overnight drama.

2. Scalper: Think of day traders on steroids. They’re dealing in big numbers and aiming to make a quick buck (or rupee) in less time than it takes to microwave popcorn.

3. Swing Trader: These are the slightly more patient cousins. They’ll hold onto stocks for a few days or weeks, like they’re nursing a lukewarm cup of coffee.

You’ve got big shots like George Soros and Ed Seykota who’ve turned this quick-draw approach into an art form.

Investors: The Slow and Steady Bunch

On the flip side, we’ve got the investors. These folks are playing the long game, like they’re waiting for cheese to age:

1. Growth Investors: They’re always on the hunt for the next big thing. They spotted companies like Hindustan Unilever in the 90s and rode that wave all the way to the bank.

2. Value Investors: These are the bargain hunters of the stock market. They’re scooping up solid companies when everyone else is running for the hills, like buying L&T during a market nosedive.

You’ve got legends like Warren Buffett and Peter Lynch who’ve turned this slow-cooker approach into billions.

So, what’s your flavor? Are you itching for the quick thrill of trading, or do you have the patience of a saint for long-term investing? It all comes down to what kind of financial rollercoaster you want to ride.

Remember, in this game, you can be a sprinter or a marathon runner – just make sure you’re wearing the right shoes for the race you choose!

8. The Stock Market Index

Imagine being asked to summarize the traffic situation in your city in real-time. With thousands of roads and junctions, checking each one would be impractical, right? Instead, you’d wisely observe key roads and junctions across the city’s directions. If chaos reigns, you’d label the traffic as chaotic; otherwise, it’s normal. These key spots serve as indicators for the entire city’s traffic.

Similarly, assessing the stock market’s movement involves simplification. With thousands of listed companies, examining each is daunting. Instead, focus on pivotal companies across key sectors. If most are rising, markets are up; if falling, markets are down; if mixed, markets are sideways. These chosen companies collectively form the stock market index.

So, when asked about the market’s status, a glance at these stocks’ trends provides a quick answer, just like observing traffic on key roads tells the city’s story.

Indices

Understanding the overall market sentiment doesn’t require tracking individual companies. Instead, we rely on pre-packaged tools like market indices. In India, the main indices are the S&P BSE Sensex for the Bombay Stock Exchange (BSE) and S&P Nifty 50 for the National Stock Exchange (NSE).

The S&P tag comes from Standard and Poor’s, a global rating agency, which licenses its expertise to construct the index. CNX Nifty, on the other hand, is managed by India Index Services & Products Limited (IISL). It is a joint venture of NSE and CRISIL.

These two indices (Sensex & Nifty) offer real-time insights into market perceptions. When they rise, it indicates optimism among investors about the future, while a drop suggests pessimism. By observing these indices, we can gauge the collective mood of market participants without diving into individual stocks.

Decoding Index Movement

Indices serve various practical purposes in the stock market.

1. Information: Indices reflect market trends, offering insights into the economy’s health. An upward index suggests optimism, while a downward one signals pessimism. For instance, if an index rises from 6,000 to 7,800 points in a year, it indicates a 30% increase, reflecting a bullish outlook.

2. Benchmarking: Investors use indices to gauge their performance. If an investor earns a 20% return while the index rises by 30%, they may perceive underperformance. The goal is often to outperform the index.

3. Trading: Traders often trade indices, anticipating broader economic shifts. For instance, ahead of a budget speech expected to boost the economy, traders might buy the index, expecting it to rise.

4. Portfolio Hedging: Investors hedge their portfolios against market downturns using indices. If they anticipate a market slump, they may use index derivatives to protect their long-term investments.

Index Calculation

The calculation of indices like the Sensex or Nifty using the free float methodology involves several steps. It is done to ensure an accurate reflection of the market’s performance while considering the actual availability of shares for trading.

Firstly, the free float methodology focuses on the market capitalization of companies, which is the total value of a company’s outstanding shares. However, instead of considering all shares, it only includes shares available for trading in the open market. It excludes locked-in shares held by promoters, governments, or strategic investors.

To calculate the free float market capitalization of a company, one multiplies the total number of freely tradable shares by the current market price per share. This figure reflects the portion of a company’s equity that is actively traded and available to investors.

Next, the free float market capitalization of all companies included in the index is summed up. This cumulative value represents the total market capitalization of the index.

Then, the index divisor comes into play. The index divisor is a scaling factor used to maintain the continuity of the index over time, adjusting for corporate actions such as stock splits, mergers, or rights issues. It ensures that changes in the index value accurately reflect changes in the underlying stock prices.

Finally, the index value is calculated by dividing the total market capitalization of the index by the index divisor. This computation yields a figure that represents the weighted average of the constituent stocks’ prices, adjusted for their free-float market capitalization.

Example Calculation

Let’s illustrate the calculation of an index using a hypothetical scenario with three companies: Company A, Company B, and Company C.

1. Free Float Market Capitalization Calculation:

– Company A: 10 million freely tradable shares x 50/share = 500 million

– Company B: 5 million freely tradable shares x 80/share = 400 million

– Company C: 8 million freely tradable shares x 60/share = 480 million

2. Total Free Float Market Capitalization:

– Total = 500 million (Company A) + 400 million (Company B) + 480 million (Company C)

– Total Free Float Capitalization = 1.38 billion

3. Index Divisor:

– Let’s assume an arbitrary index divisor of 10.

4. Index Calculation:

– Index = Total Free Float Market Capitalization / Index Divisor = 1.38 billion / 10 = 138 million

– So, the hypothetical index value is 138 million

Now, let’s consider a scenario where there’s a stock split in Company A, doubling the number of its freely tradable shares to 20 million. This event necessitates an adjustment to the index divisor to maintain continuity.

5. Post-Adjustment:

– Company A: 20 million freely tradable shares x 30/share = 600 million

– Total Free Float Market Capitalization = 600 million (Company A) + 400 million (Company B) + 480 million (Company C) = 1.48 billion

– New Index = 1.48 billion / 10 = 148 million

So, after the adjustment, the index value changes from 138 million to 148 million. It reflects the change in the total market capitalization of the index due to the stock split in Company A.

9. Company’s Actions & Stock Price

Ever wondered what happens to your stock holdings when a company makes an announcement? This guide will dissect four common corporate actions and how they impact your investment.

Understanding the Impact: A Look at Four Key Events

Dividends: Sharing the Profits

Imagine a company decides to distribute a portion of its earnings to shareholders. This distribution is called a dividend, typically paid per share. Companies might declare dividends annually or distribute them intermittently throughout the year (interim dividend vs. final dividend).

There’s a crucial date to remember: the ex-dividend date. Only shareholders who own the stock before this date are eligible to receive the dividend. The stock price usually dips slightly on the ex-dividend date to reflect the payout.

Bonus Issue: A Shower of Free Shares

A bonus issue is a company’s way of rewarding shareholders with additional shares. These free shares are issued out of the company’s reserves, typically in a fixed ratio (e.g., 2:1 bonus). So, if you hold 100 shares with a 2:1 bonus, you’ll receive 200 additional shares, bringing your total to 300.

While the number of shares increases, the overall value of your investment remains the same. This is because the company essentially divides the existing value among more shares.

Stock Splits: Dividing the Stock Pie

A stock split is another way to potentially increase shareholder participation. Here, the company splits each existing share into multiple shares with a lower face value. For instance, a 1:2 stock split would convert your 1 share (Rs. 10 face value) into 2 shares (Rs. 5 face value each).

Similar to a bonus issue, the total value of your investment stays the same after the split. However, the lower share price might attract more retail investors.

Rights Issue: A Selective Share Offering

When a company needs to raise capital, it might issue rights to existing shareholders. These rights give you the privilege (but not the obligation) to buy new shares at a discounted price, typically proportional to your current holdings.

Remember: Subscribing to a rights issue requires additional investment. It’s crucial to analyze the company’s prospects before participating and compare the subscription price to the market price.

Buybacks: When Companies Repurchase Shares

A buyback occurs when a company buys back its own shares from the market. This reduces the number of outstanding shares, potentially increasing the value per remaining share. Buybacks can also signal the company’s confidence in its future.

By understanding these corporate actions, you’ll be better equipped to make informed decisions about your stock holdings.

10. External Factors Affecting The Stock Market

The stock market is a complex ecosystem, influenced by more than just individual companies. This guide dives into external factors that can significantly impact stock prices.

Understanding the Big Picture: Key Economic Events

Monetary Policy: The Balancing Act

Imagine the Reserve Bank of India (RBI) as the conductor of the economy’s orchestra. Their primary instrument? Interest rates. By adjusting these rates, the RBI influences borrowing and spending, impacting corporate growth and inflation.

– High-Interest Rates: A double-edged sword. While they discourage excessive borrowing, they can also slow economic growth.

– Low-Interest Rates: Easier borrowing fuels spending, but it can also lead to inflation, eroding the purchasing power of money.

The RBI carefully navigates these opposing forces by setting key rates like the repo rate (interest rate on loans from RBI to banks) and the cash reserve ratio (CRR) (amount of money banks must keep with RBI). Investors closely monitor these decisions, as they can trigger reactions across various sectors like banking, auto, and real estate.

Inflation: The Price of Everything Going Up

Inflation is the gradual rise in the cost of goods and services. While some inflation is expected, a high rate can disrupt the economy. Governments strive to keep inflation under control using various tools.

– Measuring Inflation: Two Key Indexes

– Wholesale Price Index (WPI): Tracks price changes at the wholesale level (between businesses).

– Consumer Price Index (CPI): Measures price changes experienced by consumers, a more relevant indicator for everyday life.

Investors watch these indexes closely, as high inflation can signal economic unease, potentially leading to market downturns.

Industrial Production: A Gauge of Manufacturing Health

The Index of Industrial Production (IIP) is a monthly snapshot of India’s industrial activity. It reflects the overall health of this crucial sector by comparing current production to a baseline year.

– Rising IIP: Indicates a vibrant industrial environment, a positive sign for the economy.

– Falling IIP: Signals sluggish production, potentially leading to market corrections.

Investors track IIP data to assess the overall economic climate and make informed decisions.

Purchasing Managers’ Index (PMI): A Peek into Business Activity

The PMI is a survey-based indicator that reflects business sentiment in manufacturing and service sectors. Purchasing managers report on changes in factors like new orders, output, and employment.

– PMI Above 50: Indicates expansion in the economy.

– PMI Below 50: Signals contraction, potentially leading to market weakness.

Investors watch the PMI to gauge overall business health and identify potential economic trends.

Budget Announcements: Shaping the Future

The annual budget presentation by the Finance Minister outlines the government’s financial plans and economic policies. These announcements can significantly impact various industries and stock prices. For example, increased taxes on cigarettes might decrease cigarette companies’ profitability, leading to potential stock price declines.

Corporate Earnings: Numbers Talk

Listed companies are required to report their quarterly earnings, providing insights into their financial performance. Investors compare these actual results to their expectations (“street expectations”).

– Earnings Beat Expectations: Positive surprise, often leading to stock price increases.

– Earnings Miss Expectations: Disappointment, potentially triggering stock price drops.

– Earnings Meet Expectations: This may lead to flat or slightly negative price movement.

By understanding these external factors and their impact on stock prices, you’ll be better equipped to navigate the ever-changing market landscape.

Conclusion

You’ve conquered the first chapter of your stock market education! Now, it’s time to take the training wheels off and explore the exciting world of analysis.

Why So Many Modules? It’s All Connected!

Each module is a piece of equipment designed to train a specific skill. You might be wondering how these skills all fit together.

The secret weapon? Developing a Point of View (POV) on stocks and the market. This is your educated guess about whether a stock will rise or fall. To build a strong POV, you’ll need a toolbox of analysis methods.

Building Your POV Toolbox: Three Key Approaches

– Fundamental Analysis (FA): Imagine a company as a building. FA examines the company’s financial health, like its earnings and growth potential, to see if it’s built to last.

– Technical Analysis (TA): This approach focuses on the price and volume history of a stock, using charts and patterns to predict future movement. It’s like reading a stock’s price chart like a language.

– Quantitative Analysis (QA): This method uses math and statistics to analyze data and uncover hidden trends. It’s like having a superpowered calculator to assess risk and reward.

Choosing Your Trading Weapon

Once you have a POV, it’s time to pick the right trading instrument – the tool that matches your strategy.

– Delivery Trade (Buying the Stock): Ideal for a long-term bullish view (you think the stock will rise steadily). It’s like buying a whole house, expecting its value to appreciate over time.

– Futures: Perfect for a short-term bullish view (you think the stock will rise quickly). It’s like signing a contract to buy the house at a set price in the future.

– Options: These offer flexibility for a bullish view with some caution. Imagine having the option (but not the obligation) to buy the house at a certain price by a certain time.

The Winning Formula: POV + The Right Instrument

Imagine a skilled carpenter. They wouldn’t use a hammer to drill holes! Just like that, a well-researched POV paired with the perfect trading instrument is your recipe for market success.

Get Ready to Level Up!

By now, you see how each Varsity module connects to build your stock market knowledge. Dive deeper into the next two modules to master the art of developing a POV through Technical and Fundamental Analysis. Soon, you’ll be exploring the different trading instruments to put your POV into action, all while learning effective risk management techniques.

So, grab your metaphorical toolbox and get ready to explore the exciting world of stock analysis!

Have a happy investing.

Disclaimer: The information provided in my articles and products is for informational purposes only and should not be considered as financial or investment advice.