As interest rates in India are higher compared to those in Western countries, many NRIs prefer investing in India. This preference is driven by the significant difference in interest rates between India and developed countries. To capitalize on this disparity, NRIs often choose to open an NRI bank account in India. There are three types of NRI bank accounts available:

1. FCNR Account

2. NRE Account

3. NRO Account

In this article, we will focus on the key features of the NRO Account.

What is an NRO Account?

NRO Account stands for Non-Resident Ordinary Account. It can be opened by Non-Resident Indians (NRIs) or Persons of Indian Origin (PIOs) settled abroad (excluding those in Nepal and Bhutan). This type of NRI account can be opened as a Savings Account, Current Account, Recurring Deposit, or Term Deposit.

Unlike the FCNR Account, which is operated in foreign currency, the NRO Account operates solely in Indian Rupees. This makes it ideal for NRIs who have income in India, such as rent, dividends, and pensions.

Most banks also issue debit and ATM cards for NRO Accounts, which can be used for cash withdrawals and at merchant locations within India.

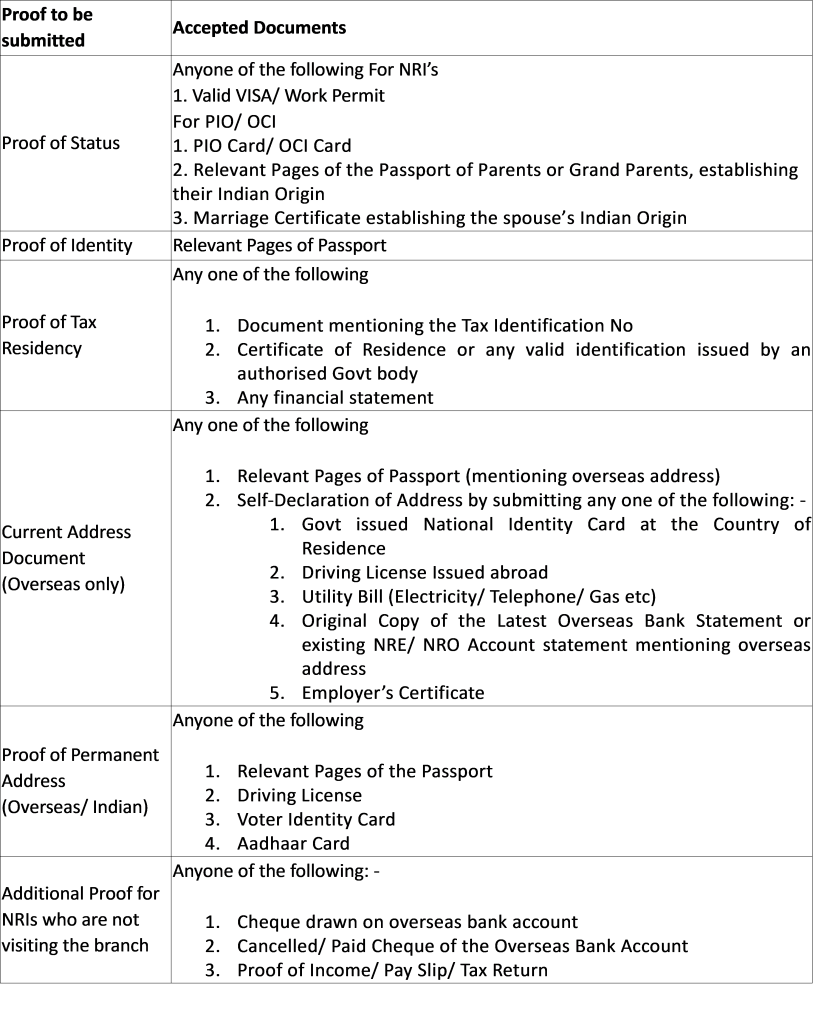

Documents Required for Opening an NRO Account

To open an NRO Account, the following documents are typically required:

Funds for Opening an NRO Account

NRO Accounts can be opened with:

1. Funds received as foreign inward remittances in convertible currency through regular banking channels. Foreign currency travelers’ cheques or notes may be accepted during temporary visits by the NRI, for credit to the account.

2. Legitimate local dues denominated in Indian Rupees, such as rent, dividends, pensions, interest, and sale proceeds of assets.

Tax on NRO Accounts

NRO Accounts are used to receive funds earned from Indian sources. Since this income is earned in India, the funds in NRO Accounts are liable to tax in India. Regardless of the country in which the NRI resides, money earned from Indian sources is subject to Indian taxes.

The interest payable on NRO Accounts varies across different banks in India, and NRIs are advised to check these interest rates on the respective bank websites.

Repatriation of Funds Outside India

NRIs may remit up to $1 million per calendar year from balances held in an NRO Account. This amount can come from the sale proceeds of assets acquired in India with rupee or foreign currency funds, or through inheritance from a resident Indian, provided:

(a) Assets acquired in India out of rupee/foreign currency funds:

– Immovable property: NRIs and PIOs may remit sale proceeds of immovable property purchased while they were residents or with rupee funds as NRIs or PIOs.

– Other financial assets: There is no lock-in period for remittance of sale proceeds of other financial assets from an NRO Account.

(b) Assets acquired by way of inheritance:

– Sale proceeds of assets acquired through inheritance can be remitted. No lock-in period applies if the authorized dealer is satisfied that the proceeds are from inherited property.

Some NRIs mistakenly believe that all NRI accounts are tax-free, but this is not the case.